Texas 2290: Heavy Vehicle Use Tax Guide for 2025

Texas moves more freight than any other state, and that means a lot of owner-operators and fleets need “Texas 2290” proof fast to keep trucks registered, plated, and rolling. The key thing to know is this: Form 2290 is a federal Heavy Vehicle Use Tax (HVUT), but Texas registration and IRP processes commonly require your IRS-accepted Schedule 1 as proof.

This guide breaks down what Texas truckers need for the 2025 HVUT season, how the deadlines work, what Texas offices typically want to see, and how to avoid the filing mistakes that slow down renewals.

What “Texas 2290” actually means (HVUT basics)

“Texas 2290” is industry shorthand for filing IRS Form 2290 and getting Schedule 1 so you can handle Texas registration, renewals, or apportioned plates. The tax itself is federal and applies nationwide.

In general, you must file Form 2290 if:

- You register (or are required to register) a highway motor vehicle in your name, and

- The vehicle has a taxable gross weight of 55,000 pounds or more, and

- It is used on public highways during the tax period

The official IRS overview is here: About Form 2290.

Who is responsible in common Texas real-world setups?

Responsibility usually follows whoever the vehicle is registered to.

- Owner-operator (title and registration in your name): you typically file.

- Company-owned fleet: the company typically files under its EIN.

- Leased truck: it depends on whose name is on the registration. If you are unsure, confirm before filing because the EIN and name on Form 2290 must match what the IRS has on record.

If you want a general refresher on required info and the filing flow (not Texas-specific), see the site’s Form 2290 instructions.

HVUT 2025: tax period and deadlines that impact Texas registration

The HVUT tax year runs July 1 through June 30. So the “2025” HVUT season generally refers to the tax period that begins July 1, 2025 (and runs through June 30, 2026).

For most carriers who had vehicles on the road in July, the standard annual deadline is August 31 (or the next business day if it falls on a weekend or holiday). If you add a truck later, the due date is based on the vehicle’s First Used Month (FUM).

You can confirm dates and edge cases on the site’s dedicated page: Form 2290 due dates.

The Texas timing issue: registration renewals wait on Schedule 1

In Texas, you often need valid HVUT proof when you:

- Renew registration for a heavy vehicle

- Apply for or renew apportioned plates under IRP

- Add or replace vehicles on an existing fleet account

That means the practical deadline is sometimes earlier than the IRS deadline if your plates or IRP renewal is coming up. If your Schedule 1 is missing or rejected, you can lose days waiting.

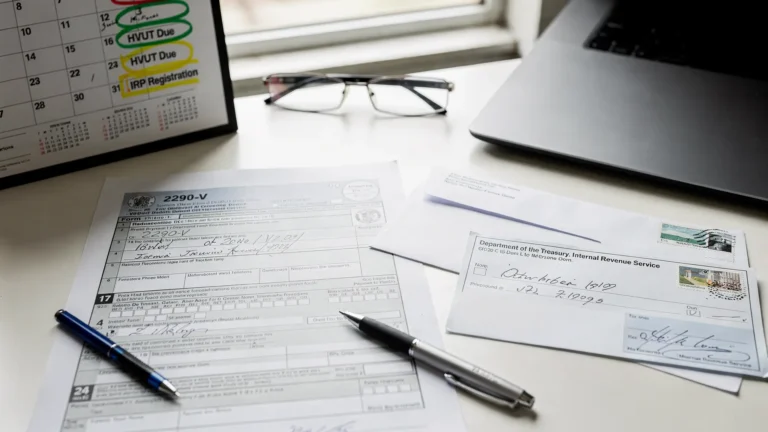

What Texas offices typically require as proof (Schedule 1)

Schedule 1 is your proof of filing and payment (or suspension) for HVUT. After the IRS accepts your return, you receive a Schedule 1 that is stamped or shows IRS e-file acceptance.

Texas processes vary by transaction type and location, but in general you should be ready to provide:

- A copy of your IRS-accepted Schedule 1 showing your EIN/name

- VIN(s) that match what you are registering

- Proof that the vehicle(s) meet the HVUT requirement (generally your vehicle details and weight class)

For IRP and motor carrier-related registration information, start with the Texas DMV motor carrier resources: Texas DMV Motor Carriers.

If you are operating apportioned plates, reference Texas’ IRP overview here: International Registration Plan (IRP) in Texas.

Quick reference: when Texas usually asks for 2290 proof

| Texas transaction | When HVUT proof is commonly requested | What to have ready |

|---|---|---|

| Registration renewal for a heavy vehicle | At renewal or when updating records | Schedule 1 with matching VIN and EIN |

| IRP renewal (apportioned plates) | During renewal processing | Schedule 1 for each taxable vehicle in the fleet |

| Adding a newly purchased truck mid-year | When registering the new unit | Schedule 1 for that VIN (often prorated by First Used Month) |

| Correcting vehicle data before plates are issued | When the discrepancy is found | Corrected return or amendment, plus updated Schedule 1 if applicable |

How to file Form 2290 from Texas and get Schedule 1 fast

Paper filing can work, but it commonly takes much longer to receive proof. If your registration or IRP renewal is time-sensitive, e-filing is usually the fastest way to get an accepted Schedule 1.

Information to gather before you file

Having the right details ready prevents most rejections:

- Your legal business name and EIN (Form 2290 cannot be filed with an SSN)

- Vehicle VIN (double-check for transposed characters)

- Taxable gross weight category (and whether it is a logging vehicle)

- First Used Month (FUM) for the vehicle in the current tax period

- Mileage status if you expect to file as suspended (low-mileage)

If you still need an EIN, the site explains the process here: How to apply for an EIN for Form 2290 filing.

Filing steps (high level)

A clean Texas 2290 workflow looks like this:

- Enter business info exactly as it appears in IRS records (name and EIN must match)

- Add vehicle details (VIN, weight, first-used month, and category)

- Choose an IRS payment method

- Transmit the return and wait for IRS acceptance

- Download and save your Schedule 1 for Texas registration or IRP

Simple Form 2290 is an IRS-authorized provider that offers a guided filing flow, bulk vehicle filing, and fast Schedule 1 delivery. You can start here: SimpleForm2290.com.

Texas HVUT amounts: what determines your 2290 tax

Your HVUT bill is not “Texas-specific”, it’s based on IRS rules. The main factors are:

- Taxable gross weight (the biggest driver)

- Vehicle type (regular vs logging)

- Month of first use in the period (can trigger proration)

If you want to estimate your bill or understand proration without doing the math manually, see: How to calculate HVUT tax for Form 2290.

Common Texas 2290 problems that delay plates or IRP renewals

When drivers say “Texas rejected my 2290”, it is usually an IRS rejection or a documentation mismatch that shows up during registration. These are the most common issues that create delays.

EIN and business name mismatch

This is one of the fastest ways to get rejected. If you recently formed an entity, changed your business name, or applied for an EIN, verify the IRS has the same name format you are using to file.

Practical tip: if you just received your EIN, the IRS may take time to fully update systems. Plan ahead when possible.

VIN errors (one character can stop everything)

Texas registration and IRP records rely heavily on VIN accuracy. A single wrong character can lead to:

- IRS rejection

- A Schedule 1 that does not match the vehicle you are trying to register

If you need to fix a VIN after filing, see the site’s guide: How to do a VIN correction for free.

Wrong taxable weight category

Weight category mistakes can cause overpayment or underpayment, and underpayment can lead to an amendment later (and another wait for acceptance). If your operation changes and your gross taxable weight increases, you may need to amend.

Filing too late for your Texas timeline

Even if you are “on time” with the IRS, you can still be late for your operational reality if:

- Your IRP renewal is being processed now

- You bought a truck mid-month and need plates quickly

- A carrier, broker, or shipper requires updated compliance documentation

If you are trying to speed things up after filing, this guide can help: Step-by-step guide to getting your 2290 Schedule 1 fast.

After you file: how to confirm acceptance and store proof

For Texas transactions, your goal is simple: get an accepted Schedule 1 and keep it accessible.

Best practices that save time during renewals:

- Save a digital copy (PDF) in at least two places (desktop plus cloud storage)

- Keep a printed copy in your permit book if you regularly handle roadside or office requests

- Use a filing system by truck number or VIN so you can pull the right Schedule 1 quickly

If you need to confirm whether your return was accepted or find the latest copy, see: How to check 2290 filing status.

Texas 2290 compliance checklist (quick and practical)

Use this before you hit submit and before you go to renew:

- Confirm your legal business name and EIN match IRS records

- Verify each VIN from the truck, not from memory

- Confirm taxable gross weight category (and logging status if applicable)

- Pick the correct first-used month for the current period

- File early if you have an upcoming Texas registration or IRP transaction

- Save Schedule 1 immediately after acceptance

Frequently Asked Questions

Is “Texas 2290” a Texas state tax? No. Form 2290 is a federal Heavy Vehicle Use Tax (HVUT). Texas offices commonly require your federal Schedule 1 as proof before they process certain registration and IRP transactions.

Do I need a stamped Schedule 1 to register my truck in Texas? In many Texas registration and IRP situations for heavy vehicles, you are typically asked for a current IRS-accepted Schedule 1 (stamped or e-file watermark) that matches your VIN and EIN.

What is the 2025 Form 2290 deadline for Texas truckers? For most vehicles used on public highways in July, the annual deadline is August 31 (or the next business day). If you put a vehicle on the road later, the due date is generally the last day of the month following the vehicle’s first used month. Always confirm with the current IRS rules and your specific situation.

What if I bought a truck mid-year in Texas? You typically file Form 2290 based on the vehicle’s first used month in the current HVUT tax period, and the tax is often prorated. Once accepted, you use the Schedule 1 as proof to register that vehicle.

Why was my 2290 rejected when everything looks correct? Common reasons include EIN and name mismatch, VIN errors, and selecting the wrong tax period or first used month. Checking the rejection code and correcting the specific issue usually resolves it.

File Texas 2290 online and get your Schedule 1 without the wait

If you need your Schedule 1 quickly for Texas registration or IRP, e-filing is usually the most reliable path. Simple Form 2290 is an IRS-authorized e-file provider built for owner-operators and fleets, with a guided step-by-step process, bulk vehicle filing, secure document storage, and bilingual customer support.

File now at SimpleForm2290.com and get your Schedule 1 delivered as soon as the IRS accepts your return.