IRS Login Online: Troubleshooting and Security Tips

Trying to access an IRS account online can be frustrating, especially when you are up against a registration deadline, a payment cutoff, or you need proof for a plate renewal. The good news is that most IRS login issues come down to a handful of fixable causes, and a few security habits can dramatically reduce the risk of lockouts, delays, or identity theft.

This guide breaks down what “IRS login online” typically refers to, how to troubleshoot common problems (ID.me, EFTPS, browser errors, verification loops), and how to keep your tax accounts and HVUT information secure.

What “IRS login online” usually means (and what it does not)

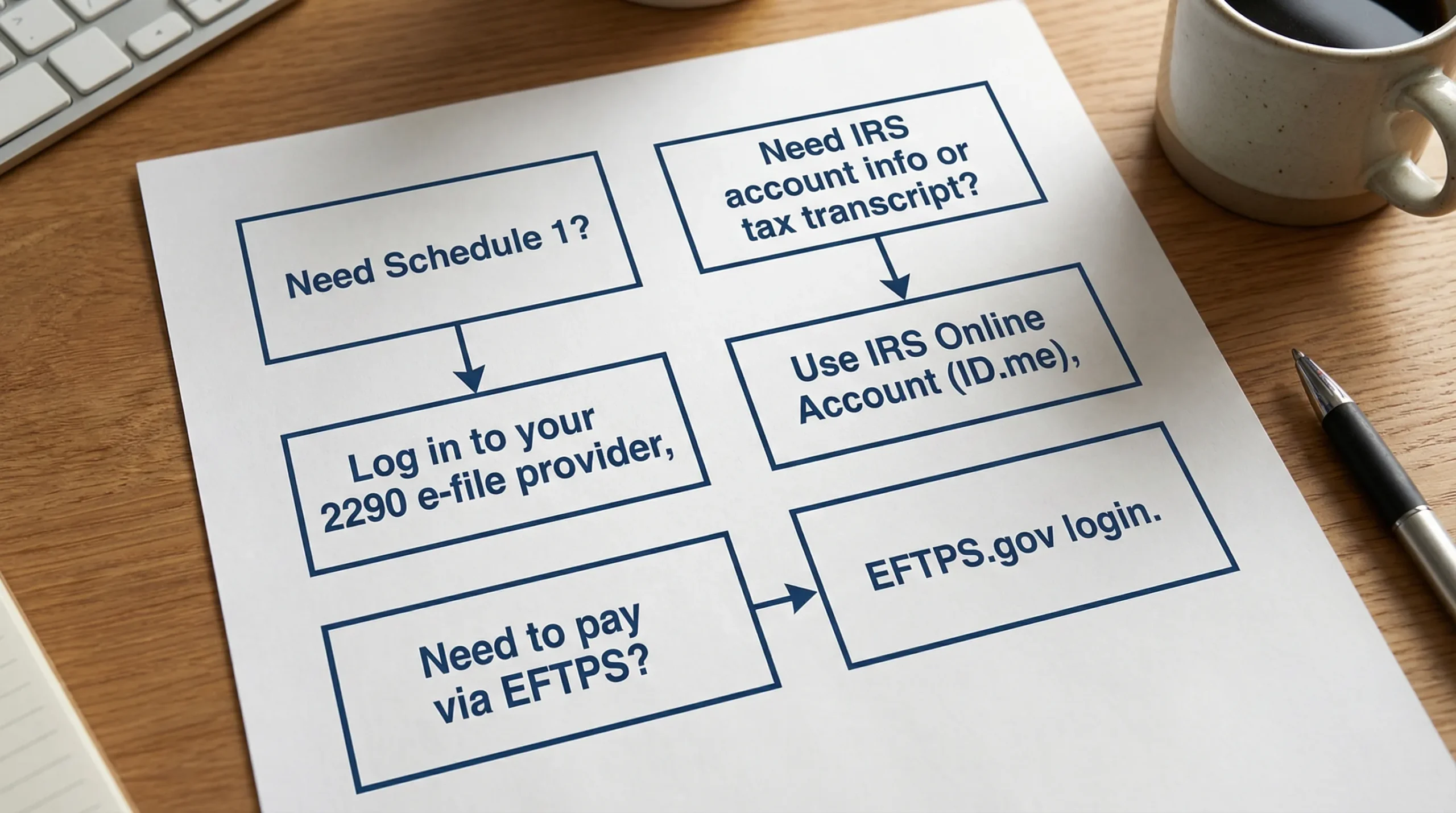

When people search for IRS login online, they are usually trying to sign in to one of these services:

- IRS Online Account (personal or business tax information): the IRS uses ID.me for identity verification and sign-in.

- EFTPS (Electronic Federal Tax Payment System): a separate portal at EFTPS.gov used to schedule and make federal tax payments.

It is also common to mix up an IRS account login with a Form 2290 e-file provider login.

- The IRS does not provide Schedule 1 instantly just because you can log into an IRS account.

- If you e-file Form 2290 through an IRS-authorized provider, your stamped Schedule 1 is delivered after the IRS accepts your return through the e-file system.

If your immediate goal is “I need Schedule 1 fast,” your best next step is usually logging into your e-file provider account (not the IRS Online Account). SimpleForm2290 explains how that IRS acceptance process works on its IRS overview page.

Confirm you are on the real IRS site before you troubleshoot anything

A surprising number of login problems are not technical at all. They happen because someone ends up on the wrong site (or a lookalike) and then gets stuck, or worse, shares sensitive information.

Before entering an EIN, SSN, password, or verification code, confirm:

- The domain is irs.gov for IRS Online Account tools.

- The domain is eftps.gov for EFTPS.

- The browser shows a secure connection (lock icon) and no odd misspellings in the address.

During peak filing seasons, scammers often buy search ads that appear above the real IRS result. Consider bookmarking the official pages you use.

Here is a quick reference table to reduce misroutes.

| Service people mean by “IRS login online” | What it’s used for | Correct official site |

|---|---|---|

| IRS Online Account (via ID.me) | View tax info, notices, some payment and transcript options | IRS Online Account |

| ID.me (Secure Access) | Identity verification and sign-in for IRS tools | IRS Secure Access / ID.me info |

| EFTPS | Schedule and pay federal taxes electronically | EFTPS.gov |

| IRS Direct Pay | Pay taxes from a bank account without EFTPS enrollment | IRS Direct Pay |

IRS login troubleshooting: the most common problems and how to fix them

Many sign-in errors are caused by verification settings, browser blockers, or account lockouts. Work through the sections below in order. You will often fix the problem in 5 to 10 minutes.

1) “My password is correct, but it won’t let me in”

Common causes include repeated failed attempts, old saved passwords, or typing issues on mobile.

What to try:

- Use the site’s Forgot password option instead of guessing.

- Turn off auto-fill temporarily and type credentials manually.

- If you recently changed your password, delete old saved credentials in your browser password manager.

- If you see a lockout message, wait the required time window before trying again.

2) ID.me verification loop or “We can’t verify your identity”

ID.me may ask for identity verification steps that fail due to document images, device permissions, or mismatched information.

What to try:

- Use a well-lit photo of your government ID with no glare, and ensure edges are visible.

- Make sure your name and address details match what the system expects (even small formatting differences can matter).

- Try a different device (phone instead of desktop, or vice versa).

- Disable VPNs during identity verification.

If you still cannot verify, use the help options within ID.me or the IRS Secure Access guidance page: Secure Access registration help.

3) Two-factor authentication (2FA) codes are not arriving

2FA failures are frequently caused by carrier filtering, phone number changes, or time sync issues (for authenticator apps).

What to try:

- If you can choose a method, switch from SMS to an authenticator app when possible.

- Confirm your phone has service and is not blocking short codes.

- If you use an authenticator app, make sure your device time is set to automatic (incorrect time can invalidate codes).

- If you changed your phone number, you may need to update recovery options before you can sign in smoothly again.

4) Browser problems (white screen, endless loading, buttons not clickable)

Government and financial logins are sensitive to privacy settings and blockers.

What to try:

- Use a modern browser (Chrome, Edge, Firefox, Safari) and update it.

- Clear cache and cookies for the IRS or ID.me domain.

- Disable ad blockers, script blockers, or “strict” privacy extensions temporarily.

- Try an incognito/private window.

- Try a different network (home Wi‑Fi instead of public Wi‑Fi).

5) “We are unable to complete your request” or generic error messages

These often appear during high traffic or when a session times out.

What to try:

- Sign out completely, close the browser, reopen, then try again.

- Attempt login during off-peak hours (early morning or late evening).

- Avoid running multiple IRS or ID.me sessions in different tabs.

6) EFTPS login issues (enrollment, PIN, or banking problems)

EFTPS is separate from IRS Online Account. Many users get stuck because they are trying to “create” an EFTPS account at the last minute.

Important notes:

- EFTPS enrollment can involve receiving a PIN by mail, so it is not always instant.

- If you cannot access EFTPS in time, you may need an alternative IRS payment method depending on what you are paying.

For Form 2290, the IRS allows multiple payment options, and your e-file provider can guide you through them. SimpleForm2290 summarizes Form 2290 payment options in its IRS page.

Fast diagnosis table: match the symptom to the fix

Use this table to narrow down the most likely cause.

| Symptom | Most likely cause | What to do next |

|---|---|---|

| Correct password, still denied | Lockout or wrong saved password | Reset password, remove saved credentials, wait out lock window |

| Stuck during ID verification | Document image quality or data mismatch | Retry with better photos, disable VPN, use a different device |

| 2FA code never arrives | Carrier filtering or outdated phone number | Switch 2FA method, check short code blocking, update recovery settings |

| Page loads incorrectly | Browser cache, blockers, outdated browser | Clear cookies/cache, disable extensions, update browser |

| Generic “unable to complete request” | High traffic or session issue | Retry later, restart browser, avoid multiple tabs |

| EFTPS login not possible | Not enrolled or PIN not received | Use official EFTPS help routes or choose an alternative payment method if eligible |

Security tips for IRS online accounts (especially for truckers and fleet businesses)

If you manage a trucking business, your IRS-related data is high value: EINs, addresses, payment history, sometimes employee data, and in HVUT workflows you also handle VINs and operational details. Treat your IRS login like you treat a bank login.

Use stronger credentials and safer sign-in methods

- Use a unique password for IRS/ID.me and EFTPS, never reuse a dispatch, email, or social password.

- Prefer an authenticator app for 2FA when available, it is typically harder to intercept than SMS.

- Store recovery codes securely (offline is best), so you are not locked out if a phone is lost.

Protect your EIN, VIN list, and Schedule 1 copies

A common operational reality is sharing documents with a registrar, IRP office, third-party admin, or employee. Reduce your risk with a simple policy:

- Share only what is required (for example, the Schedule 1 page needed for registration).

- Do not email full credential sets or store them in shared notes.

- Avoid sending VIN lists through unsecured messaging.

If you e-file Form 2290 through a provider, choose one that emphasizes secure storage and retrieval so you are not searching through old inboxes during renewal season.

Watch for IRS-themed scams that target logins

The IRS repeatedly warns taxpayers that it generally does not initiate contact through email, text messages, or social media to request personal or financial information. Review the IRS scam guidance here: IRS scams and fraud alerts.

Red flags that often show up in “IRS login” scams:

- A message claiming your account will be suspended unless you “verify now.”

- Links that do not go to irs.gov or eftps.gov.

- Requests for your full EIN/SSN plus a one-time code.

Keep your devices “boring and updated”

Login security is not only about passwords. It is also about the device used to sign in.

- Keep phone and computer operating systems updated.

- Use a screen lock on phones and laptops.

- Avoid logging in on shared computers (truck stop kiosks, public library machines).

- If you must use public Wi‑Fi, do not access sensitive accounts unless you have a secure, trusted connection method.

If your goal is Form 2290 compliance, you may not need an IRS Online Account at all

For many owner-operators and fleet managers, the practical need is:

- File Form 2290 accurately

- Pay HVUT

- Get a stamped Schedule 1 quickly

- Retrieve Schedule 1 later for IRP registration or renewals

That workflow is typically handled through an IRS-authorized e-file provider, not through an IRS Online Account login.

If you are waiting on proof of filing, start with your provider account and filing status first. SimpleForm2290 outlines what common filing statuses mean (Accepted, Rejected, Pending) and what to do next in How to Check 2290 Filing Status.

If you have not filed yet and you need Schedule 1 quickly, SimpleForm2290 is an IRS-authorized platform designed for online 2290 filing with features that matter to trucking operations, including a guided filing process, bulk vehicle filings, bilingual support (English/Spanish), and secure document retrieval.

When to contact the IRS vs when to contact your e-file provider

Knowing who to contact saves hours.

Contact the IRS when the issue is truly IRS account or payment related

Examples:

- You cannot complete ID.me verification for an IRS Online Account.

- You need help with IRS notices or account-level issues.

- You have payment questions for IRS tools such as EFTPS or Direct Pay.

If you need official Form 2290 support lines and what to have ready (EIN, VIN, prior Schedule 1), use this resource: IRS Customer Support Phone Numbers.

Contact your e-file provider when the issue is about Form 2290 filing status, Schedule 1, or corrections

Examples:

- Your Form 2290 was rejected and you need to correct details and resubmit.

- You need a copy of your IRS-stamped Schedule 1.

- You need a VIN correction or an amendment.

These are common “deadline week” problems, and a provider’s support team can often resolve them faster than trying to navigate multiple IRS portals.

A simple security and troubleshooting workflow you can reuse

When something breaks, run this quick sequence:

- Confirm you are on the correct official site (irs.gov or eftps.gov).

- Try a private window and disable extensions.

- Reset password rather than guessing.

- Fix 2FA method issues (authenticator app, phone number, time sync).

- If the goal is Schedule 1, check your e-file provider status first.

Get unstuck and stay compliant

“IRS login online” issues are common, especially when you are juggling identity verification, multi-factor authentication, and time-sensitive filing tasks. The key is separating which system you actually need (IRS Online Account, EFTPS, or your e-file provider portal), then applying a structured troubleshooting approach without compromising security.

If your immediate objective is Form 2290 compliance and a stamped Schedule 1, use an IRS-authorized e-file provider and check your filing status directly. You can start or manage your 2290 filing through SimpleForm2290 and use their resources to stay on track with deadlines and documentation.