File Form 2290 in Pennsylvania

If you’re registering or renewing a heavy truck in Pennsylvania, there’s one document you usually cannot move forward without: an IRS stamped Schedule 1 from your Form 2290 (Heavy Highway Vehicle Use Tax, HVUT) filing. Whether you’re an owner-operator running out of Philadelphia, a small fleet in Harrisburg, or hauling across state lines under IRP, filing Form 2290 correctly and on time helps you avoid delays, penalties, and tag issues.

This guide explains how to file Form 2290 in Pennsylvania, what you need before you start, and how to get your Schedule 1 quickly.

What is Form 2290 (HVUT) and why Pennsylvania truckers care

Form 2290 is the federal return used to report and pay the Heavy Highway Vehicle Use Tax for certain highway vehicles. Most truckers deal with it because Pennsylvania registration and IRP processes commonly require proof of HVUT payment, which is your watermarked Schedule 1.

The tax generally applies when you have a highway motor vehicle with a taxable gross weight of 55,000 pounds or more.

For IRS background, see the official IRS overview of Form 2290.

Who must file Form 2290 in Pennsylvania

Your location does not change the federal rule. If you’re based in Pennsylvania, you generally need to file Form 2290 when:

- You own, register, or operate a heavy vehicle (55,000 lbs or more taxable gross weight) on public highways.

- You put a truck on the road for the first time during the HVUT tax period (your filing is based on the first-used month).

- You need an IRS stamped Schedule 1 for registration, renewal, or apportioned plates.

If you’re not sure whether you must file, this guide explains the common cases: Who must file Form 2290.

Pennsylvania registration and Schedule 1: what to expect

In Pennsylvania, trucking businesses often need a stamped Schedule 1 when they:

- Register a newly purchased heavy truck.

- Renew registration for an existing heavy vehicle.

- Update apportioned registration (IRP) that requires current HVUT proof.

PennDOT processes can vary by situation and location (for example, whether you’re working through a tag agent, messenger service, or a motor carrier office). If you need Pennsylvania-specific registration guidance, start with PennDOT Driver and Vehicle Services at DMV.PA.gov.

The key point is consistent: Schedule 1 is your proof that the IRS has accepted your 2290 filing.

What you need before you file Form 2290

Having the right details ready makes your filing faster and reduces IRS rejections.

| What you need | Where to find it | Why it matters |

|---|---|---|

| EIN (Employer Identification Number) | IRS EIN confirmation letter | The IRS requires an EIN for Form 2290 (SSN/ITIN is not accepted). |

| Business name and address | IRS records | Must match IRS records to reduce rejections. |

| VIN(s) | Truck title, registration, or cab card | VIN errors are a top cause of rejection. |

| Taxable gross weight | Registration docs, spec sheet, fleet records | Determines the HVUT category and tax amount. |

| First-used month | When the vehicle first operated on public highways | Determines due date and prorated tax (if applicable). |

| Payment method | EFTPS, debit/credit card, check, or other IRS options | Filing and paying are related, but not always done in the same place. |

If you still need an EIN, here’s the step-by-step guide: How to apply for an EIN online for Form 2290 filing.

Form 2290 due dates (important for Pennsylvania fleets)

Form 2290 deadlines are based on your first-used month.

- Most carriers with vehicles first used in July file for the new HVUT tax year and are typically due by August 31 (the IRS deadline can shift slightly when it falls on a weekend or holiday).

- If you put a truck on the road later (for example, first used in January), your return is generally due by the last day of the following month.

For a clear month-by-month breakdown, use: Form 2290 due dates.

How to file Form 2290 in Pennsylvania (fastest method: e-file)

Pennsylvania does not require a special state version of Form 2290, you file federally with the IRS. The fastest way to get your stamped Schedule 1 is typically to e-file through an IRS-authorized provider.

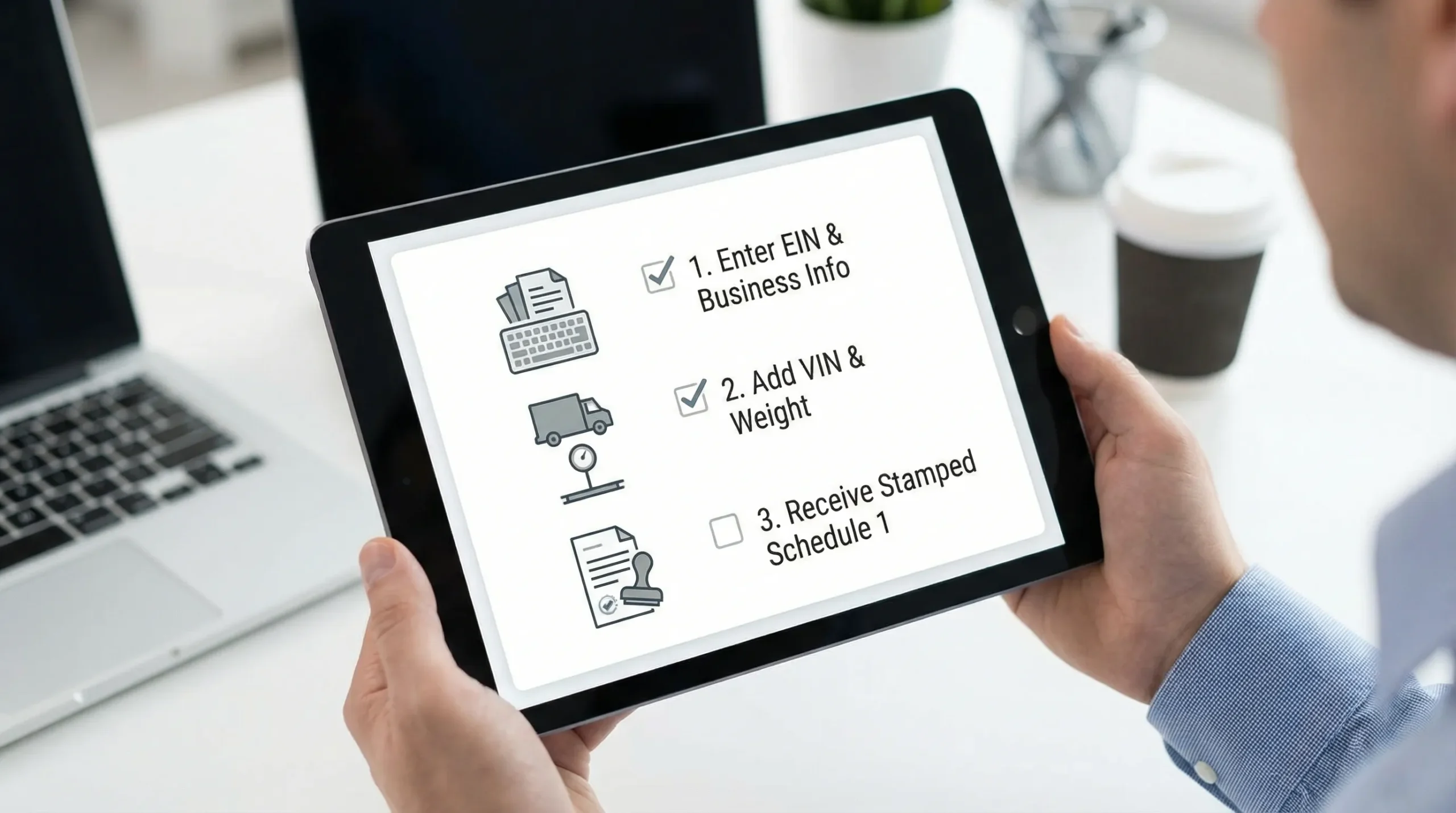

Create your online filing account

Start by creating an account (or logging in) with an IRS-authorized 2290 e-file provider.

With Simple Form 2290, you can begin here: SimpleForm2290.com.

Enter your business and vehicle information

You’ll enter your EIN and business details, then add vehicle information such as VIN, weight category, and first-used month. If you’re filing for multiple trucks, bulk entry tools can save time.

Review your tax calculation and submit the return

Your HVUT is based mainly on taxable gross weight, vehicle category (including logging status where applicable), and the first-used month (proration applies for vehicles first used mid-year).

If you want to understand the math behind it, see: How to calculate HVUT tax for Form 2290.

Receive your stamped Schedule 1

After IRS acceptance, you receive your watermarked Schedule 1 (proof of filing/payment) which you can use for registration and compliance.

For Schedule 1 details and common issues, read: Schedule 1 Form 2290: What you need to know.

Do you need to “sign into my IRS account” to file Form 2290?

Many Pennsylvania truckers search “sign into my IRS account” when they’re trying to handle HVUT. Here’s the practical reality:

- To file Form 2290: You generally do not need to sign into an IRS online account if you are e-filing through an IRS-authorized provider.

- To pay the tax: Depending on how you pay (for example, EFTPS), you may use IRS-approved payment systems that require separate login steps.

- To check IRS notices or account info: An IRS online account can help, but it is not the same as filing the 2290 itself.

If you’re ever unsure, focus on the deliverable you need for Pennsylvania: an IRS accepted return and stamped Schedule 1.

Common Pennsylvania filing situations (and what to do)

You bought a truck and need plates or IRP work done fast

If you just purchased a heavy truck and it’s being placed into service, your first-used month triggers the filing due date. E-filing is usually the quickest way to get Schedule 1 for registration.

Your filing is rejected (VIN, EIN, duplicates)

IRS rejections happen, but they are usually fixable. Common causes include:

- VIN entered incorrectly

- EIN/business name mismatch

- Duplicate filing for the same VIN and tax period

To monitor progress and understand status messages, use: How to check 2290 filing status.

If the issue is a VIN typo, you may need a VIN correction filing (not a full refile). See: How to do VIN correction for free.

You’re reporting a suspended vehicle (low mileage)

If you expect the vehicle to stay under the IRS mileage threshold for the tax period, you may need to file as suspended (you still file, but tax may not be due). Details here: How to file Form 2290 for suspended vehicles.

Your taxable gross weight increased

If your truck moves into a higher weight category during the year, you may need a weight increase amendment. Guide: How to update Form 2290 for an increase in gross weight.

Paper filing from Pennsylvania (possible, but slower)

You can still mail a paper Form 2290, but it typically takes significantly longer to receive your stamped Schedule 1 compared with e-filing.

If you choose to mail, make sure you send it to the correct IRS address for your payment situation. Reference: IRS mailing address for Form 2290.

Why Pennsylvania owner-operators and fleets e-file with Simple Form 2290

When the goal is getting your stamped Schedule 1 quickly (often needed for registration timing), e-filing through an IRS-authorized provider is usually the most efficient path.

Simple Form 2290 offers:

- An IRS-authorized online filing portal with a guided, step-by-step process

- Fast delivery of your Schedule 1 after IRS acceptance

- Bulk filings for fleets

- Secure data storage and retrieval for future access

- Bilingual customer support (English/Spanish)

- Affordable flat pricing (including a $9.95 option shown on the site)

If you want a walkthrough of the online process, see: How to efile form 2290 with Simple Form 2290.

Frequently Asked Questions

Do I need to file Form 2290 if my truck is registered in Pennsylvania? Yes, if your highway vehicle is 55,000 pounds or more taxable gross weight and it’s used on public highways, you generally must file federally, no matter the state.

What do I need for Pennsylvania registration after filing Form 2290? You typically need your IRS stamped Schedule 1 (watermarked copy) as proof of HVUT filing/payment.

Can I file Form 2290 online and get Schedule 1 the same day in Pennsylvania? In many cases, yes. With e-filing, Schedule 1 is typically available shortly after IRS acceptance (timing can vary).

Do I have to sign into my IRS account to file Form 2290? Usually no. You can e-file through an IRS-authorized provider without an IRS account login. Some payment methods may require separate credentials.

What if my Form 2290 is rejected because of a VIN error? You’ll usually need to correct the VIN and resubmit. If the IRS accepted the return with an incorrect VIN, you may need a VIN correction filing.

Where can I check my Form 2290 filing status? If you e-filed, you can check status through your e-file provider account dashboard. You can also review common status explanations here: https://www.simpleform2290.com/how-to-check-2290-filing-status.

File Form 2290 in Pennsylvania now

If you need your stamped Schedule 1 for Pennsylvania registration, IRP work, or compliance, e-filing is typically the fastest option.

File online with Simple Form 2290 here: SimpleForm2290.com.