File Form 2290 in Georgia

File Form 2290 in Georgia

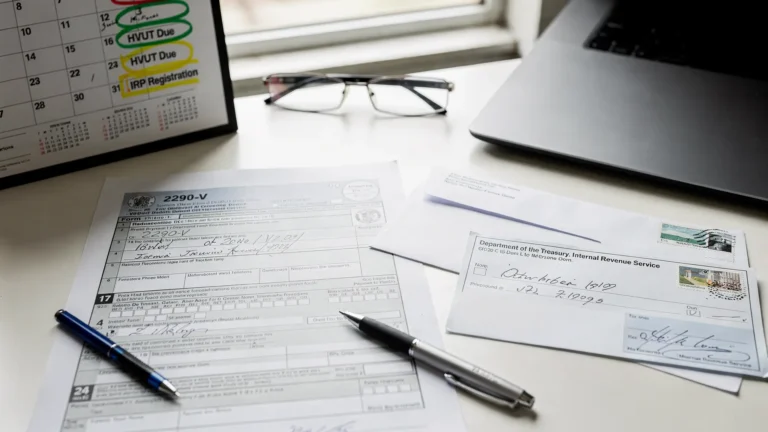

Georgia-based truck owners and fleet operators who run heavy vehicles on public highways may need to file IRS Form 2290 and pay the Heavy Vehicle Use Tax (HVUT). This is a federal tax (not a Georgia state tax) that applies based on a vehicle’s taxable gross weight and how it’s used during the tax period. Filing accurately matters because an IRS-accepted return generates Schedule 1, which is commonly required for registration and renewals.

If you need to file Form 2290 in Georgia, the key is understanding whether your vehicle is taxable, choosing the correct first used month, and submitting the return to the IRS on time.

Who Needs to File Form 2290 in Georgia

You generally must file IRS Form 2290 if you own (or register) a heavy highway motor vehicle and it is used on public highways during the tax period. This includes many:

- Owner-operators based in Georgia

- Georgia trucking companies with titled or registered vehicles

- Fleet managers responsible for multiple vehicles under one EIN

In most cases, Form 2290 applies when:

- The vehicle has a taxable gross weight of 55,000 pounds or more, and

- The vehicle is used on public highways (even if it is not used every day)

Form 2290 filing responsibility is tied to the person or business that is registering the vehicle (or required to register it) in their name. If a vehicle is registered in your business name, the IRS generally expects the return to be filed using that same business name and EIN.

Some vehicles may be reported as suspended (generally for low-mileage use), but they still must be reported on Form 2290 to document their status.

| Situation | Do you usually need to file Form 2290? | What to prepare |

|---|---|---|

| Georgia-based truck 55,000 lbs or more used on highways | Yes | EIN, VIN, taxable gross weight, first used month |

| Vehicle expected to stay under the low-mileage limit for the tax period | Yes, typically filed as suspended | EIN, VIN, first used month, suspension category |

| Fleet with 25 or more vehicles to report | Yes, and IRS requires e-file | Vehicle list (VINs, weights), business info, payment method |

For general IRS guidance, you can also review the IRS overview of Form 2290.

Georgia Form 2290 Filing Requirements

When completing Georgia Form 2290 filings, the information is the same nationwide because it is an IRS form. The most common filing requirements that affect accuracy include:

Taxable gross weight

Taxable gross weight is not just the empty weight of the truck. It generally includes:

- The unloaded weight of the vehicle

- The unloaded weight of any trailers customarily used with it

- The maximum load customarily carried

Selecting the correct weight category is important because it directly affects the HVUT amount due. If your operations change and your taxable gross weight increases later, an amended filing may be required.

First used month

The IRS uses a “first used month” rule. That means the tax and due date can depend on the month your vehicle was first used on public highways during the tax period.

- For vehicles first used in July, the annual HVUT filing is generally due by August 31.

- For vehicles first used in other months, the return is generally due by the last day of the month following the month of first use.

HVUT tax calculation and compliance

HVUT is calculated based on weight category and vehicle type (for example, logging vehicles have different tax rates than regular vehicles). If you want background on how the tax is determined, see the SimpleForm2290 explanation of HVUT.

How to File Form 2290 in Georgia

If you plan to file Form 2290 in Georgia, you have two main options: paper filing by mail or electronic filing through an IRS-authorized provider.

Option 1: E-file (most practical for many Georgia filers)

E-filing is often the most practical approach because it reduces mailing time and provides faster IRS acknowledgment. It’s also required by the IRS when reporting 25 or more vehicles on a return.

To e-file through SimpleForm2290, you can use the page to E-File Form 2290 Online. SimpleForm2290 is an IRS Authorized 2290 Efile Provider, which means the platform is approved to transmit Form 2290 returns to the IRS.

Option 2: Paper filing by mail

Paper filing is still allowed, but it typically involves longer processing times and mailing logistics. If you choose paper filing, make sure you mail to the correct IRS address based on whether you include a payment with the return. See the SimpleForm2290 reference for the IRS Mailing Address.

When Georgia businesses are managing multiple trucks, paper filing can add administrative effort (printing, mailing, tracking delivery, and waiting for stamped proof).

Printable Form 2290 Georgia vs Online Filing

Many people searching for Form 2290 Georgia resources want to know whether it’s better to print and mail the form or submit it online. The right choice depends on your situation, but here is a neutral comparison.

| Filing method | How it works | Typical processing and proof |

|---|---|---|

| Printable and mail (paper) | Complete Form 2290 and mail to the IRS | Processing can take weeks, and stamped Schedule 1 can be delayed (especially in peak season) |

| Form 2290 Georgia online (e-file) | Submit electronically through an IRS-authorized provider | IRS acknowledgment is typically faster, and Schedule 1 is generally available soon after acceptance |

If you need proof of filing for a registration or renewal timeline, online submission may help reduce waiting. This is one reason many filers choose Form 2290 Georgia online filing when time matters.

Schedule 1 and Proof of Filing in Georgia

Schedule 1 is the proof of HVUT filing and payment (or suspended filing, when applicable) for the vehicle(s) reported on Form 2290. After the IRS accepts your return, you receive an IRS-stamped Schedule 1.

Georgia truck owners commonly use Schedule 1 for:

- Vehicle registration and renewals

- IRP-related documentation requests

- Internal compliance records for fleets

If you want to see what Schedule 1 includes and why it matters, review the SimpleForm2290 resource on Form 2290 Schedule 1.

Bulk Fleet and Specialized Form 2290 Filings in Georgia

Georgia fleets and growing carriers often run into Form 2290 scenarios beyond a single annual filing. These situations are normal in trucking operations and should be handled using the correct IRS process.

Bulk fleet filings (multiple vehicles)

If you manage many trucks, you may want a workflow designed for submitting and tracking multiple vehicles under one account. SimpleForm2290 provides information on Bulk Fleet Filings for fleet operators who need to manage higher-volume filings.

Amendments and corrections

Amendments may be needed when something changes after you file or when a correction is required. Common examples include:

- VIN correction if a VIN was entered incorrectly on the original return

- Taxable gross weight increase if the vehicle moves into a higher weight category

- Suspended vehicle status changes if a vehicle exceeds the mileage limit and becomes taxable

For an overview of these cases, see Amendments, Corrections & Specialized Filings.

For specific amendment types:

Handling these items promptly helps keep your HVUT records consistent, especially when you need an updated Schedule 1.

How SimpleForm2290 Helps Georgia Filers

SimpleForm2290 is built to support IRS-compliant Form 2290 filing for owner-operators and fleets who need to file accurately and keep proof of submission accessible.

Georgia filers commonly use SimpleForm2290 for:

- A guided online process to complete Form 2290 with required details (EIN, VIN, weight, first used month)

- Electronic submission through an IRS-authorized provider

- Schedule 1 delivery after IRS acceptance

- Support for bulk vehicle reporting and common amendment types

- Account access for saving and retrieving filing records

- Bilingual support (English and Spanish)

If your goal is to file Form 2290 in Georgia with fewer manual steps and clearer tracking, using an online platform can help you submit the return and maintain your HVUT documentation in one place.

FAQs

Who needs to file Form 2290 in Georgia? Truck owners and businesses generally must file if they register and operate a vehicle with a taxable gross weight of 55,000 pounds or more on public highways. Some low-mileage vehicles may be reported as suspended, but they are still typically included on Form 2290.

When is Form 2290 due for Georgia truck owners? For vehicles first used in July, the annual deadline is generally August 31. For vehicles first used in other months, the deadline is usually the last day of the month following the month of first use.

Can I file Form 2290 Georgia online? Yes. You can file electronically through an IRS-authorized e-file provider, which is often faster than mailing a paper return and can speed up access to Schedule 1 after IRS acceptance.

What is Georgia Form 2290 Efile? Georgia Form 2290 Efile means submitting the federal Form 2290 return electronically for a vehicle registered or operating from Georgia. The form and tax rules are federal, but Georgia-based truckers use e-filing to meet IRS HVUT compliance and obtain Schedule 1.

When will I receive my Schedule 1 after filing? After the IRS accepts your Form 2290 return, Schedule 1 is issued as proof of filing. With e-filing, Schedule 1 is typically available shortly after acceptance, while paper filing can take significantly longer due to mail and processing time.

File Form 2290 in Georgia online with SimpleForm2290

If you are ready to file Form 2290 in Georgia, SimpleForm2290 provides an IRS-authorized way to submit your HVUT return online, receive your Schedule 1 after IRS acceptance, and keep your filing records available for registration and compliance needs. Start your filing here: E-File Form 2290 Online.