What Is Form 2290-V and When Do You Need It for HVUT Payment?

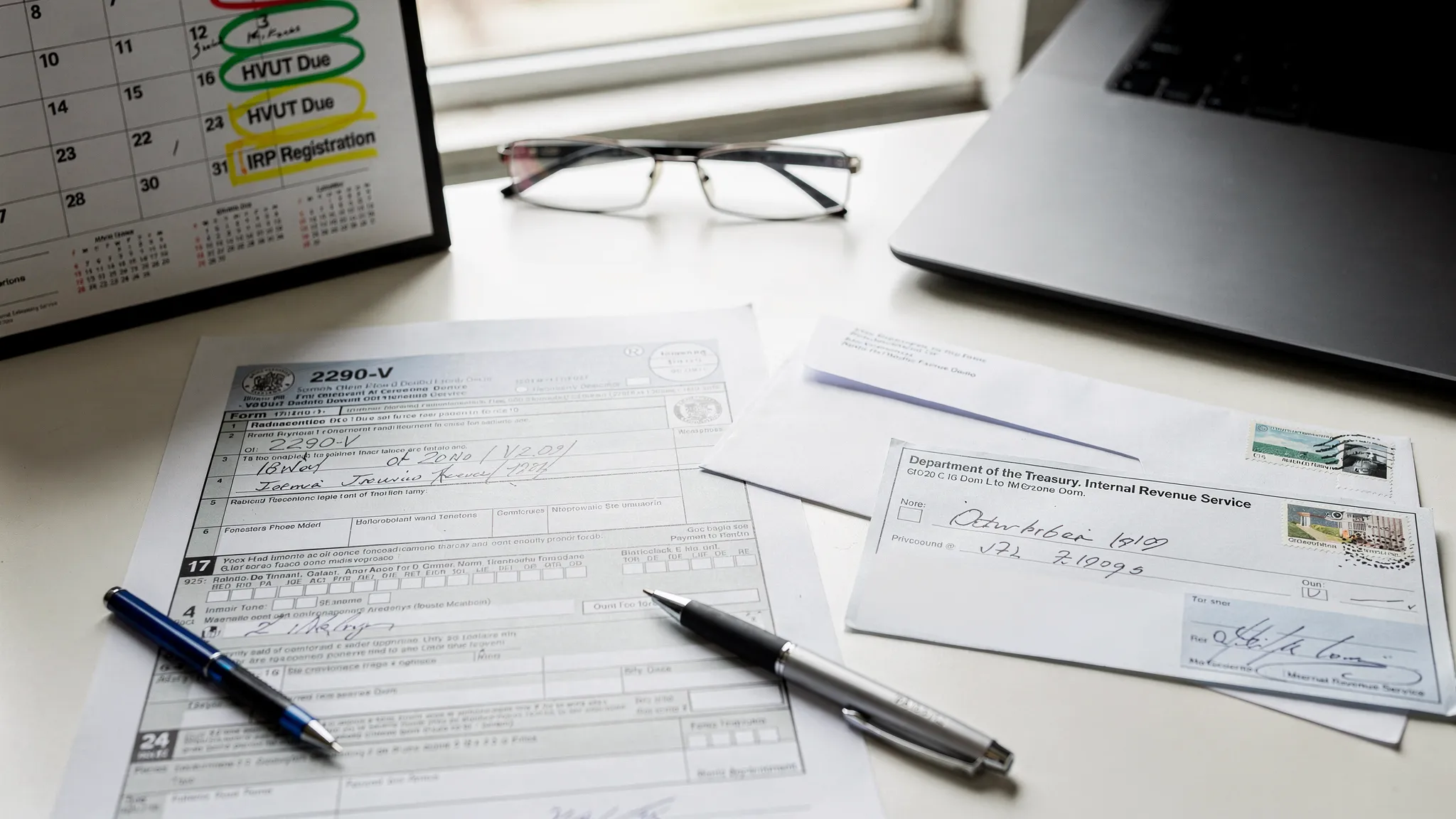

If you have ever been stuck waiting on Form 2290 Schedule 1 so you can finish IRP truck registration, you already know that paying HVUT correctly is not just “accounting”, it is operational. One small detail that still trips up owner-operators and fleet admins every season is Form 2290-V, the HVUT payment voucher.

This guide explains what Form 2290-V is, when you actually need it, when you do not, and how to choose a payment method that matches your schedule, cash flow, and registration deadlines.

What is Form 2290-V?

Form 2290-V (Payment Voucher) is a short IRS voucher used to send a payment for Heavy Vehicle Use Tax (HVUT) when you pay by check or money order. Think of it as the “payment cover sheet” that helps the IRS apply your payment to the right taxpayer and tax period.

You will see it referenced as:

- irs form 2290-v

- 2290 v voucher

- hvut payment voucher or heavy vehicle use tax voucher

The voucher includes identifiers like your EIN, business name, address, and the tax period, so the IRS can match your payment to your Form 2290 filing.

For the official source, see the IRS page for Form 2290-V, Payment Voucher.

When do you need Form 2290-V for HVUT payment?

You generally need Form 2290-V when you are paying HVUT by check or money order and the payment will be mailed.

Here are the most common real-world scenarios.

You file Form 2290 on paper and pay by check or money order

If you mail a paper Form 2290 and you include a check or money order, you use Form 2290-V with that payment.

This is the traditional route, but it is usually the slowest way to get your stamped Schedule 1, especially during peak HVUT season.

You e-file Form 2290 but choose to pay by check or money order

Some filers e-file to reduce errors, but still prefer mailing a check for internal controls, bank policy, or cash management.

In that situation, you may still use Form 2290-V to submit the mailed payment. Practically, you are mixing a fast filing method with a slower payment rail.

If your goal is to get schedule 1 form 2290 due as quickly as possible for plates or IRP, this hybrid approach can create avoidable delays.

You are sending a standalone HVUT payment that needs clear IRS matching

If you are paying after an IRS notice or correcting a balance due, the voucher helps ensure your payment is credited correctly. Always follow the notice instructions first, but the concept is the same: the IRS needs clean identifiers.

When you do not need Form 2290-V

You do not need the HVUT payment voucher when you pay electronically.

Common electronic options include:

- EFTPS (Electronic Federal Tax Payment System)

- Credit or debit card payments through IRS-approved processors

- Electronic funds withdrawal options offered through some e-file workflows

In these cases, the payment is matched electronically, and a separate mailed voucher is not part of the process.

Also, you do not have to “sign into IRS” systems just to use Form 2290-V itself. The voucher is a mail-in document used with a physical payment.

The strategic decision: speed vs control (and why Schedule 1 timing matters)

Most Form 2290 problems are not “tax math” problems, they are timing and workflow problems.

The key operational requirement is that many DMVs and IRP offices want your 2290 Schedule 1 for IRP as proof of HVUT compliance before they will complete renewals. So the HVUT payment method becomes a logistics choice.

A practical comparison of HVUT payment methods

The table below is not a promise of processing time (it can vary by season), but it reflects the typical trade-offs fleets report and what the IRS process implies.

| Payment method | Do you use Form 2290-V? | Typical speed to “payment received” | Best for | Main downside |

|---|---|---|---|---|

| Electronic payment (EFTPS or e-pay in an e-file flow) | No | Fastest in practice | Filers who need Schedule 1 quickly for Form 2290 and IRP registration | Requires setting up electronic payment habits, EFTPS enrollment can take time |

| Credit/debit card (IRS processor) | No | Fast confirmation | Last-minute filers and urgent IRP cases | Processing fees may apply |

| Check or money order by mail with Form 2290-V | Yes | Slowest and most variable | Filers who require paper payment approval controls | Mail time, posting delays, higher risk of mismatches if voucher data is wrong |

Lessons learned from real operations (two anonymized examples)

Example 1, owner-operator with a tight IRP timeline: A driver files in late August and needs Schedule 1 immediately to avoid downtime at renewal. E-filing plus electronic payment is the lowest-friction path. Mailing a check with a 2290 V voucher can create a gap between “return accepted” and “payment posted,” which can delay proof of payment.

Example 2, small fleet optimizing cash flow: A fleet office wants HVUT money to leave the bank on a specific date and prefers checks for approvals. That control can be valid, but the trade is time risk. Many fleets handle this by filing earlier, or by using EFTPS with internal approval steps so payment is still electronic.

A simple timeline “chart”: what your payment method can do to your Schedule 1

Below is a quick visual to help decide based on urgency.

| Approach | Filing channel | Payment channel | Operational impact |

|---|---|---|---|

| Fastest path | E-file | Electronic payment | Often best for fast access to Form 2290 Schedule 1 |

| Hybrid path | E-file | Mail check + Form 2290-V | Return may be accepted quickly, but payment posting can slow proof |

| Slowest path | Paper file | Mail check + 2290 v voucher | Most exposed to mail and processing delays |

If you are trying to get irp truck registration done on a deadline, aligning filing and payment speed usually matters more than most people expect.

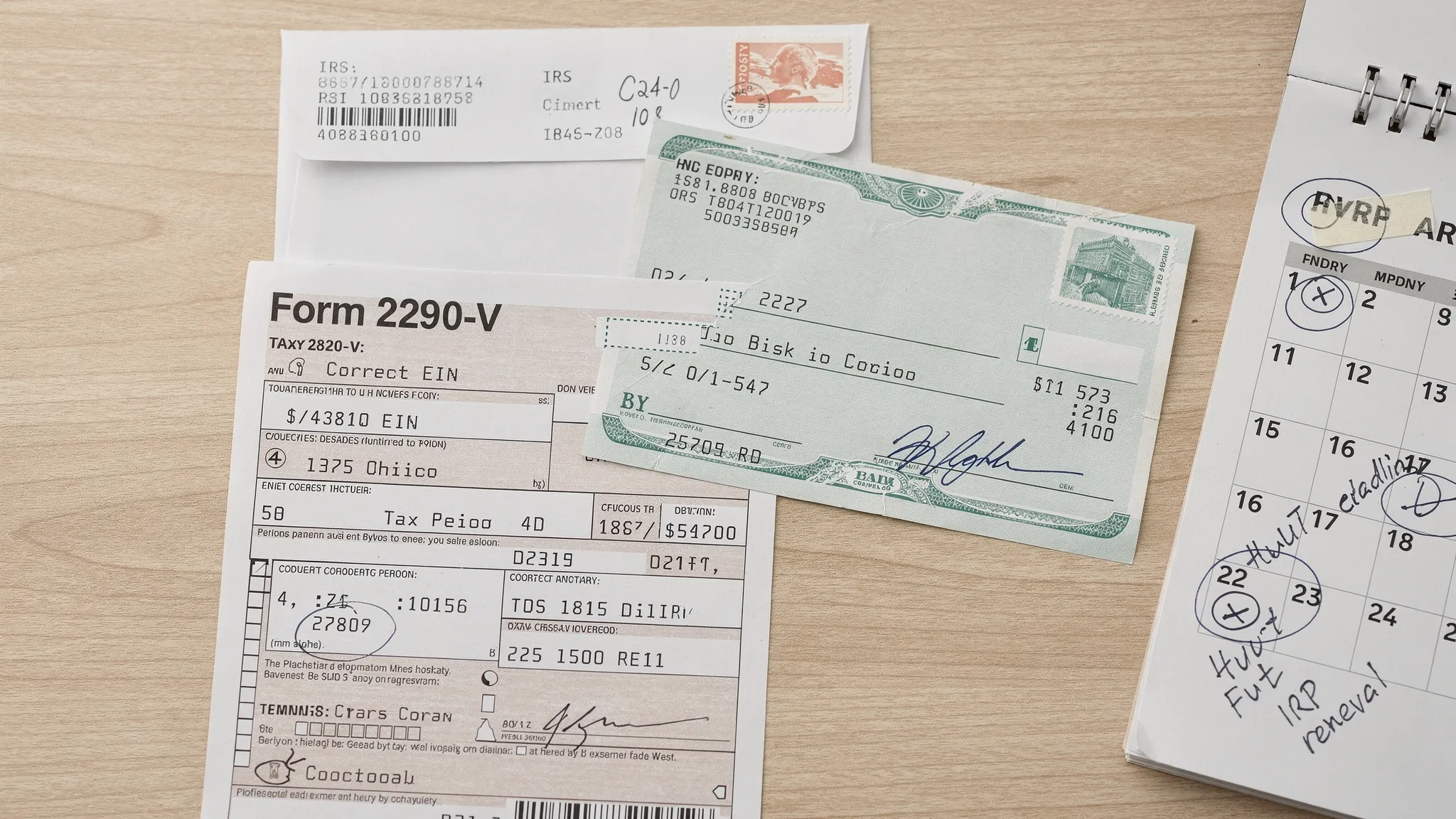

How to fill out Form 2290-V correctly (and avoid the most expensive mistakes)

Form 2290-V is simple, but it is unforgiving if the identifiers do not match what you filed.

What you must enter accurately

- EIN (not an SSN/ITIN)

- Business legal name and mailing address

- The tax period for the Form 2290 filing

- Payment amount

The most common issues that slow down payment matching

- EIN mismatch between the filed return and the voucher

- Sending a check without a correctly completed voucher

- Using an outdated address or wrong tax period

- Errors elsewhere in the filing that trigger follow-up (for example, a wrong vehicle identification number in the return)

If you want a mail route, build a quick internal review step that checks EIN, tax period, and payment amount against the accepted return summary before the envelope goes out.

For those who still file on paper, also make sure you are mailing to the right IRS address based on whether a payment is included. (You can reference the IRS rules and the practical breakdown in this guide: IRS mailing address for Form 2290.)

Trends worth knowing for 2026: why fewer fleets want mailed payments

Two trends are pushing HVUT payers away from mailed checks:

- Deadline compression in the real world: It is not just the IRS deadline, it is the IRP, tag renewal, and dispatch schedule that drives urgency.

- Process digitization: The IRS continues to encourage e-filing and electronic payments across tax products, because electronic workflows reduce manual handling and matching errors.

If your business runs seasonal surges (for example, many vehicles entering service around the same time), paper payments increase the probability of a “small mistake” becoming downtime.

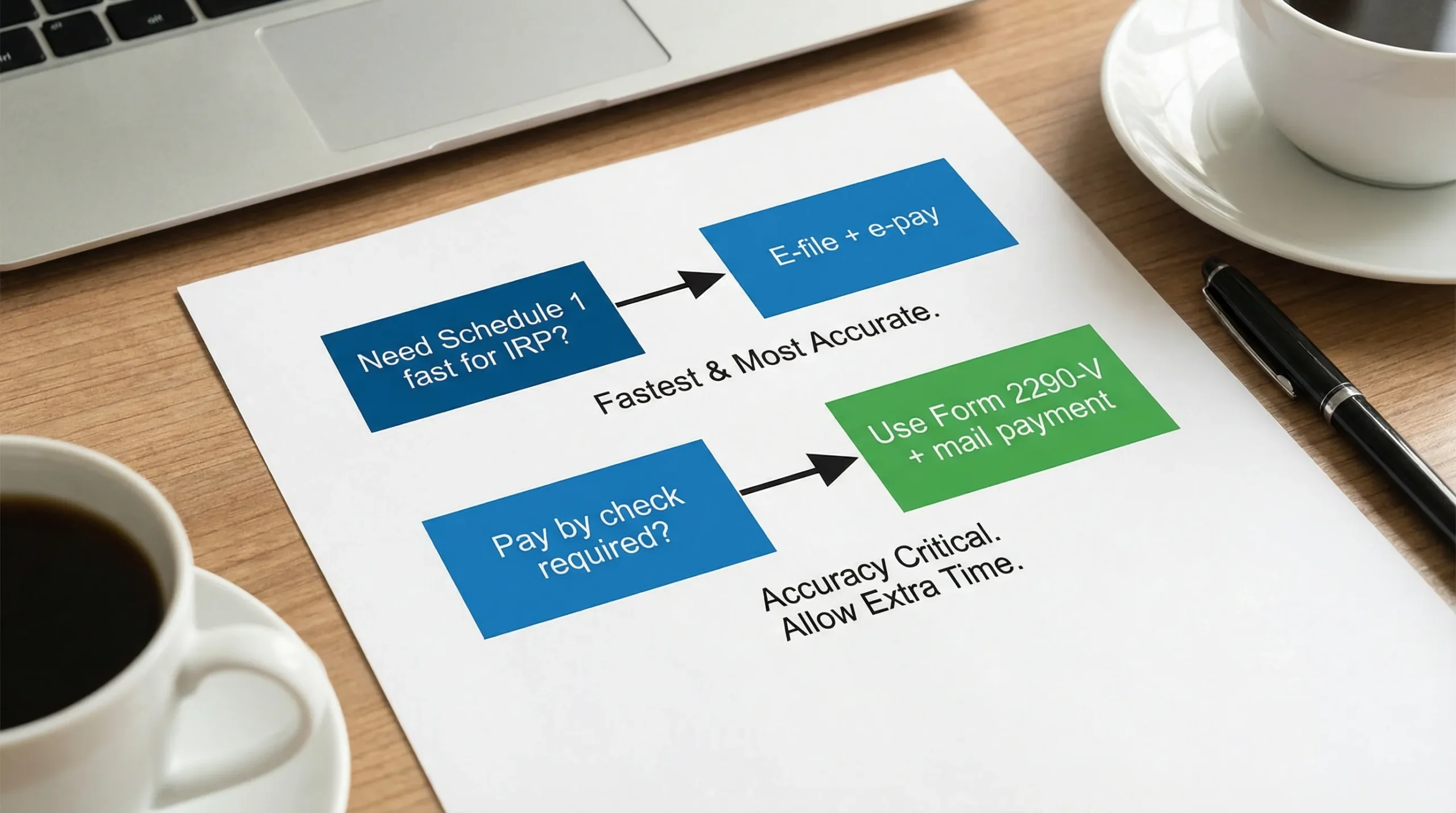

The practical playbook: choosing Form 2290-V only when it truly fits

Use Form 2290-V when your business has a real reason to mail payment (policy, approvals, bank limitations). Otherwise, it is often better treated as a fallback option.

Here is a simple decision rule many fleets adopt:

- If Schedule 1 is time-sensitive for IRP: prioritize e-file plus electronic payment.

- If cash timing and approvals matter most: use EFTPS with internal controls if possible.

- If you must pay by check: file early, double-check voucher identifiers, and mail with tracking.

Filing and paying online without the voucher (where Simple Form 2290 fits)

If your goal is to electronic file Form 2290 and pay online, using an IRS Authorized E-file Provider can reduce manual steps and help you get proof of filing faster.

Simple Form 2290 is an IRS-authorized platform designed for owner-operators and fleets to e-file securely with a guided process, bulk vehicle filing options, and fast delivery of your accepted Schedule 1 (plus bilingual support in English and Spanish).

If you want to connect this topic to the document that usually drives urgency, you may also find this helpful: Schedule 1 Form 2290: what you need to know.

The bottom line: Form 2290-V is not complicated, but it is usually slower. If you choose it, treat it like a controlled payment workflow, and do not leave it to the last week of deadline season.