Is TIN the Same as EIN? Understanding IRS Tax Identification Numbers

If you are filing taxes for a trucking business (especially IRS Form 2290 for HVUT), you will hear “TIN” and “EIN” used constantly, sometimes as if they mean the same thing. That is where confusion starts.

A TIN is a category of tax identification numbers. An EIN is one specific type of TIN. In other words, an EIN can be your TIN, but not every TIN is an EIN.

Below is a practical breakdown of IRS tax identification numbers, with trucking-specific guidance so you can avoid Form 2290 rejections and get your stamped Schedule 1 without delays.

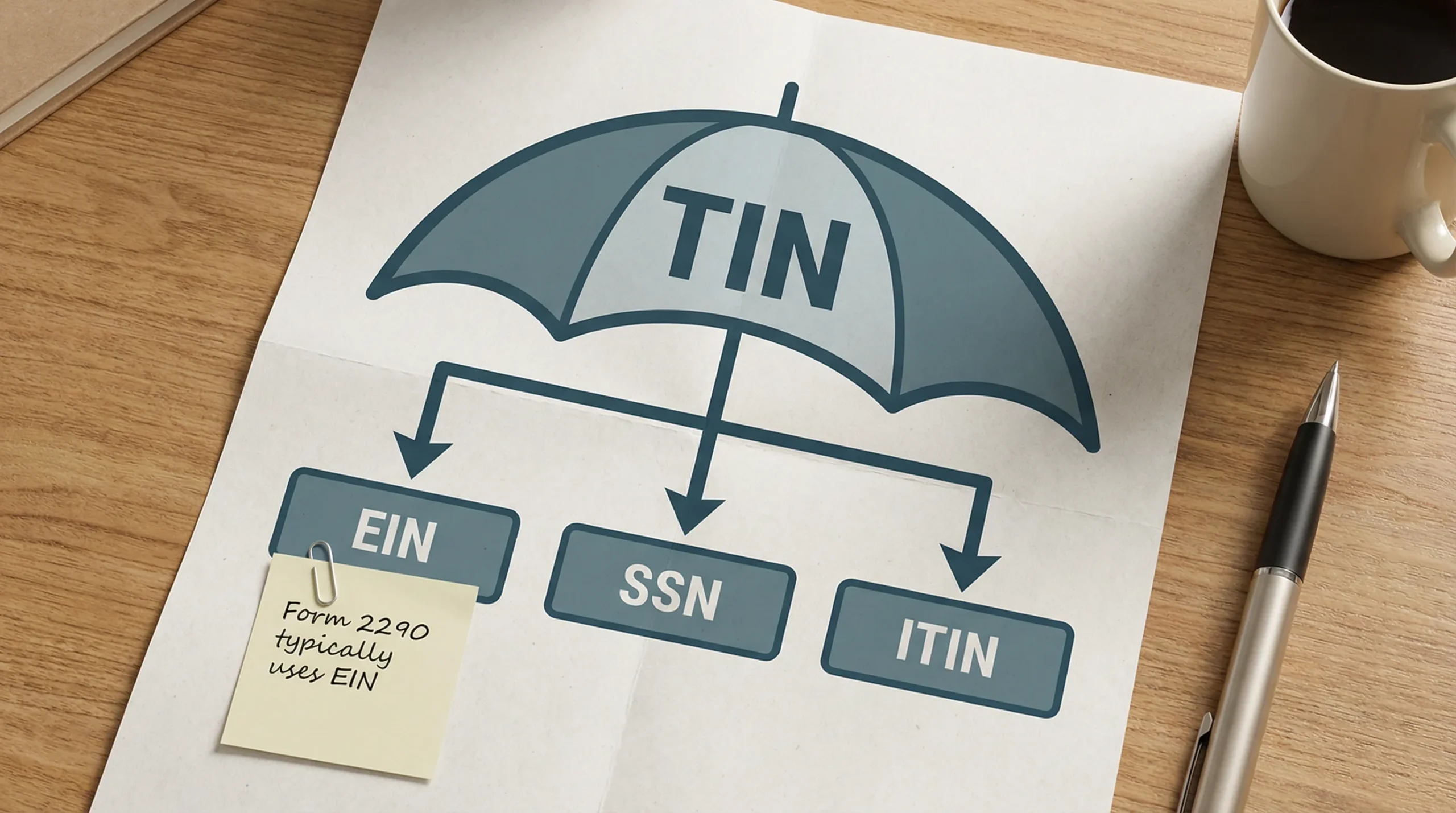

What is a TIN (Taxpayer Identification Number)?

A Taxpayer Identification Number (TIN) is the general term the IRS uses for the numbers it issues (or recognizes) to track taxpayers and administer tax laws.

- Individuals may use a TIN like an SSN or ITIN.

- Businesses typically use an EIN.

The IRS uses “TIN” as an umbrella label across forms, notices, and instructions. You can confirm this directly on the IRS overview page for Taxpayer Identification Numbers (TIN).

Is TIN the same as EIN?

Not exactly.

- TIN = the category (the umbrella term)

- EIN (Employer Identification Number) = one type of TIN (generally for businesses)

Why people mix them up

On many business tax forms, the line might say “EIN (or TIN)” or “TIN” even though the IRS expects an EIN for a business filer. In everyday conversation, people often say “my TIN” when they really mean “my EIN.”

For trucking and HVUT purposes, that distinction matters because Form 2290 requires an EIN, even for many owner-operators who do not have employees.

The main IRS TIN types (and what they are used for)

Here are the most common tax identification numbers you will see in the U.S. system.

| TIN type | Issued by | Who it’s for | Common use | Example format (not a real number) |

|---|---|---|---|---|

| SSN (Social Security Number) | SSA | U.S. citizens and eligible residents | Individual tax filing, payroll | 123-45-6789 |

| EIN (Employer Identification Number) | IRS | Businesses, partnerships, corporations, many sole proprietors | Business taxes, excise taxes, Form 2290 | 12-3456789 |

| ITIN (Individual Taxpayer Identification Number) | IRS | Individuals who need a U.S. tax ID but can’t get an SSN | Individual tax filing | 9XX-XX-XXXX |

| PTIN (Preparer Tax Identification Number) | IRS | Paid tax return preparers | Identifies the preparer on prepared returns | PXXXXXXXX |

| ATIN (Adoption Taxpayer Identification Number) | IRS | Certain adoptive parents | Temporary ID for a child pending SSN | (varies) |

If you are running a trucking operation as a business (even a single-truck owner-operator), the IRS generally expects your business tax identity to be an EIN, not your personal SSN/ITIN.

Which tax ID do you need for Form 2290 (HVUT)?

For IRS Form 2290 (Heavy Highway Vehicle Use Tax), the IRS requires an EIN.

That point is important enough to restate plainly:

You cannot e-file Form 2290 using an SSN or ITIN. The return will be rejected.

This requirement is consistently reflected in Form 2290 instructions and in IRS-authorized e-file provider validations. If you want an EIN-specific walkthrough, see our guide on how to apply for an EIN online for Form 2290 filing.

Practical impact for truckers

If you are trying to renew tags, register under IRP, or get your Schedule 1 quickly, using the correct ID is one of the biggest “make or break” items.

Even if everything else is right (VIN, weight category, first used month), the IRS can reject the filing if:

- The EIN is missing

- The EIN does not match the IRS business record

- The business name does not match what the IRS has on file for that EIN

“I just got my EIN” (why new EINs sometimes cause delays)

Many filers run into a frustrating situation: they receive an EIN confirmation and still can’t successfully e-file right away.

One common reason is that IRS systems may take some time to fully recognize a newly issued EIN across e-file and excise tax databases. This does not mean your EIN is invalid, it usually means the IRS record is still updating.

If you are on a tight deadline, it helps to apply for an EIN early and verify that your legal business name and EIN combination is entered exactly as issued.

How to find and verify your EIN (and your “business name”)

To avoid mismatches, use the official source document for your EIN:

- IRS EIN confirmation letter (often called CP 575) or other IRS confirmation notice

When you file Form 2290, the IRS compares your entry to what it has on record. The two most common mismatch issues are:

- Using a “doing business as” (DBA) name instead of the legal name tied to the EIN

- Typing differences (extra punctuation, spacing, “LLC” vs “L.L.C.”)

Best practice: Copy the legal business name exactly as it appears on your EIN confirmation.

Common TIN/EIN mistakes that lead to Form 2290 rejection

Because Form 2290 is time-sensitive for registration, it’s worth knowing the most common ID-related errors before you submit.

Using the wrong number type

Some first-time filers assume their SSN is acceptable because they are a sole proprietor. For Form 2290, that is a common (and costly) assumption.

Transposed digits

EINs include 9 digits and are easy to mistype. A single swapped digit can trigger a rejection.

Name mismatch

The IRS matching process is strict. If the IRS has “ABC TRUCKING LLC” and you file as “ABC Trucking,” you may see a rejection.

Reusing an old EIN incorrectly

If you formed a new entity (for example, moved from sole proprietor to LLC taxed as an S corporation), you may have a different EIN than the one you used years ago.

Quick guide: Which TIN should you use in common trucking setups?

This table is not legal or tax advice, but it reflects how Form 2290 is typically filed in real-world trucking operations.

| Your situation | What “TIN” usually means for you | What you should file Form 2290 with |

|---|---|---|

| Owner-operator, sole proprietor | TIN often refers to your business tax ID | EIN |

| Single-member LLC | TIN may be used generically | EIN (most common for 2290) |

| Partnership | The partnership’s business ID | EIN |

| Corporation (C-Corp or S-Corp) | Corporate tax ID | EIN |

| Fleet under a company name | Company tax ID | EIN |

When in doubt, the safest approach is: use the EIN tied to the entity that will register the vehicle and claim the Schedule 1.

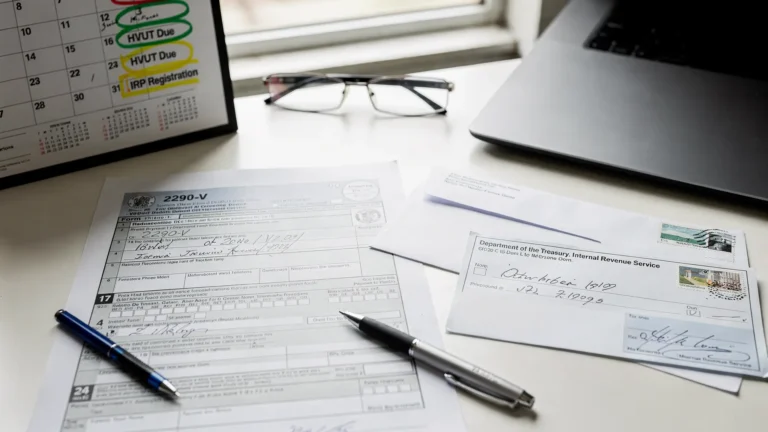

Paying HVUT: when “IRS mailing address for payments” matters

Most truckers want to avoid paper filing because it’s slower and can delay Schedule 1. But there are still situations where someone mails a return or sends a payment voucher.

If you are mailing Form 2290 with a check or money order, the IRS uses specific locations, and the correct IRS mailing address for payments depends on the type of submission. Using the wrong address can slow processing.

For the most accurate, trucking-specific breakdown (including where paper Form 2290 goes with payment vs without payment), refer to our guide on the IRS mailing address for Form 2290.

For official IRS instructions and payment methods, you can also reference the IRS Form 2290 page at irs.gov.

The fastest way to avoid TIN-related delays: e-file with an IRS-authorized provider

If your goal is to get a stamped Schedule 1 quickly for registration, e-filing typically reduces delays caused by mailing time, manual errors, and paper processing backlogs.

With an IRS-authorized e-file provider like Simple Form 2290, you can:

- Enter your EIN and business details in a guided flow

- File single trucks or bulk fleet submissions

- Receive your stamped Schedule 1 after IRS acceptance

- Get help from customer support (including English/Spanish support)

If you are ready to file, you can e-file Form 2290 directly at SimpleForm2290.com. (If you still need an EIN, start with our EIN guide linked earlier, then come back to file.)

Key takeaway

- TIN is not the same as EIN, but an EIN is a type of TIN.

- For Form 2290 (HVUT), the IRS expects an EIN, not an SSN or ITIN.

- Most filing delays and rejections tied to “TIN problems” come from wrong number type or name/EIN mismatches.

If you want to minimize rejections and get Schedule 1 fast, e-filing through an IRS-authorized provider is usually the most efficient path.