When Is Schedule 1 Form 2290 Due to the DMV?

DMV lines are long enough without showing up and hearing, “We can’t renew your tags without your stamped Schedule 1.” The confusing part is that the DMV does not set an IRS filing deadline, but it does enforce a hard operational deadline: you must have Form 2290 Schedule 1 on or before the day you register, renew, or transfer registration for a heavy vehicle.

So, when is Schedule 1 Form 2290 due to DMV? In practice, it is due whenever your state DMV (or IRP office) requires proof of Heavy Vehicle Use Tax (HVUT) payment for the registration action you are trying to complete.

This guide breaks down the timing rules, the HVUT due date mechanics that control when you can get a stamped Schedule 1, and a few strategic ways fleets avoid last-minute surprises.

What is Schedule 1, and why does the DMV care?

HVUT meaning: HVUT stands for Heavy Vehicle Use Tax, a federal excise tax reported on IRS Form 2290 for heavy highway motor vehicles that generally have a taxable gross weight of 55,000 pounds or more.

Form 2290 Schedule 1 is the IRS-stamped proof that you filed Form 2290 (and paid the tax, or reported an allowable suspended category). DMVs and IRP jurisdictions typically require it because they want evidence you are current on federal HVUT before they issue or renew registration.

For the IRS overview, see the official Form 2290 page.

The practical rule: Schedule 1 is “due” at registration time

DMV and IRP offices generally check Schedule 1 in these moments:

- Annual registration renewal or plate renewal

- IRP truck registration transactions (renewals, adding a unit, transferring plates)

- Some title and registration changes that trigger a re-registration event

That means the DMV deadline is not one universal date. It is tied to your transaction date.

Quick decision framework

If you want a simple compliance rule that works for most owner-operators and fleets:

If the DMV can’t complete your registration without it, your Schedule 1 is due before you walk into the office (or before you submit your online renewal).

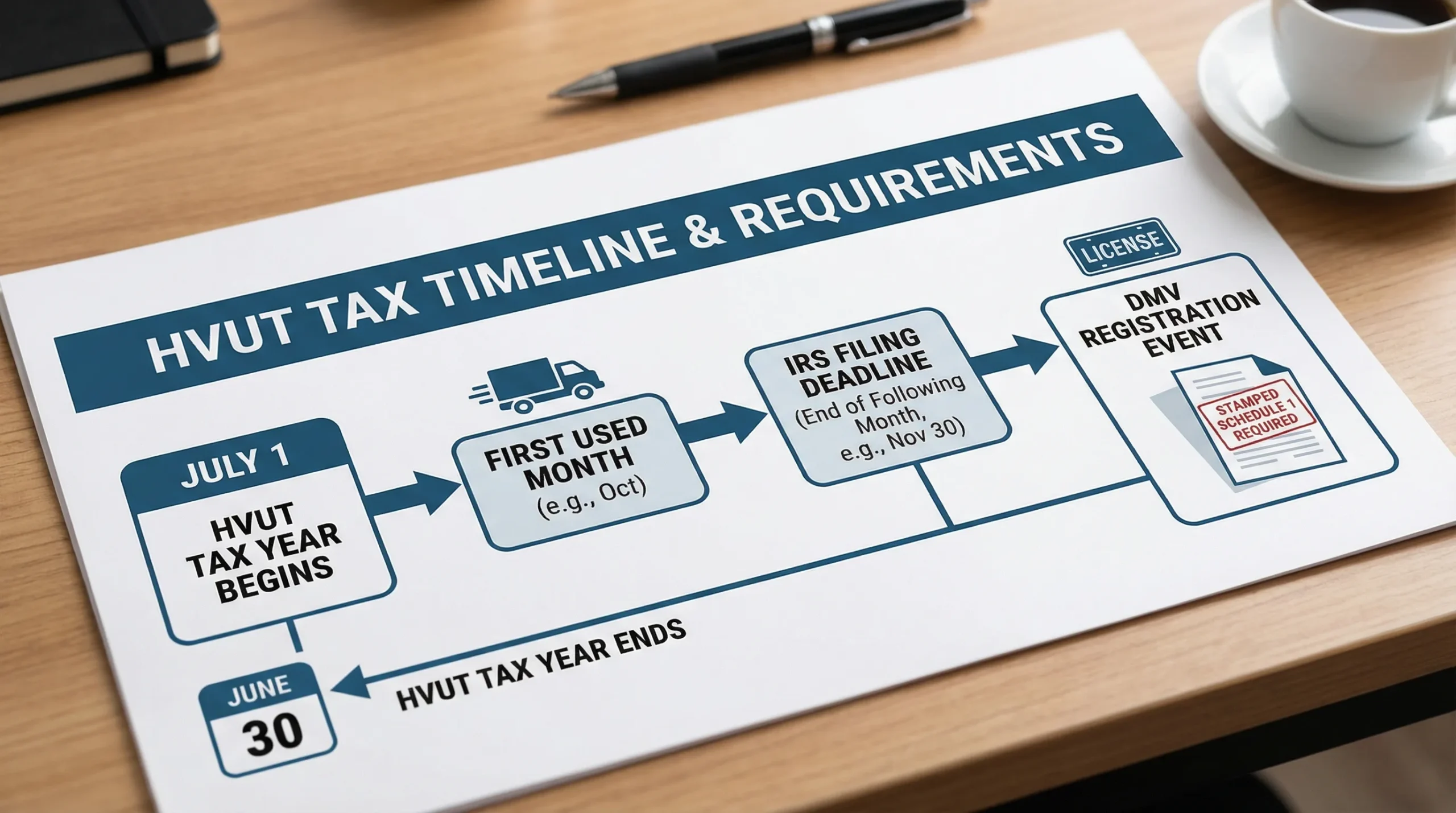

The IRS rule that controls when you can get a stamped Schedule 1

Even though the DMV sets the “show me the document” moment, the IRS sets the timeline for when you must file so you can obtain that document.

Form 2290 timing is driven by:

- The HVUT tax period (July 1 to June 30)

- Your vehicle’s First Used Month (FUM) on public highways

In general, Form 2290 is due by the last day of the month following your FUM (for example, first used in July, due by August 31). If the deadline falls on a weekend or federal holiday, it moves to the next business day.

This is why registration problems spike in late summer: many fleets renew around the annual HVUT cycle.

DMV vs IRS timing: where people get burned

The most common scheduling mistake is thinking the DMV “gives you time” after you renew. In reality:

- The DMV often requires Schedule 1 at the moment you renew or register.

- The IRS allows you to file and pay after first use, but that can still be too late if your registration event happens sooner than you planned.

Actionable table: What to do based on your situation

| Your situation | What the DMV/IRP usually requires | What you should do with Form 2290 | Why it matters |

|---|---|---|---|

| Renewing plates during the main HVUT season | Current-year stamped Schedule 1 | File early so you have Schedule 1 before renewal | Avoid downtime and rescheduled appointments |

| Newly purchased truck, putting it on the road this month | Stamped Schedule 1 listing the VIN | File Form 2290 based on the vehicle’s first use month | Registration may be blocked until proof is provided |

| Adding a truck to IRP mid-year | Schedule 1 for the VIN you are adding | File a prorated return for that unit (based on FUM) | IRP offices often verify HVUT for each VIN |

| Suspended (low-mileage) vehicle | Schedule 1 showing suspended status (if applicable) | File Form 2290 reporting suspension (Category W) | DMV still may require proof of filing, even if tax is $0 |

Because state processes vary, treat this as a planning baseline, then confirm your state’s requirements.

Speed matters: the processing-time math (and why e-file wins)

A strategic way to think about the DMV deadline is to back-plan from your appointment or renewal date.

Here is the operational reality most fleets plan around:

- Paper filing can take weeks for processing and mail delivery during peak periods.

- Electronic file Form 2290 and pay online can deliver an IRS-stamped Schedule 1 much faster once the IRS accepts the return.

The IRS itself encourages e-filing, and electronic filing is required when you file for 25 or more vehicles (see the current IRS Form 2290 instructions on IRS.gov).

Strategic takeaway: If your registration or IRP truck registration deadline is close, filing method becomes a risk decision, not just a convenience.

The IRP connection: why “2290 Schedule 1 for IRP” is a recurring pain point

Many fleets deal with a two-layer compliance stack:

- Federal HVUT filing (IRS Form 2290)

- State and multi-jurisdiction registration under IRP

This is where timing gets tight. If you are working on Form 2290 and IRP registration at the same time, your IRP transaction may effectively inherit the IRS acceptance timeline.

A real-world style lesson (common fleet scenario)

Consider a small fleet that adds two financed trucks in the middle of the year to take on a new contract. The revenue is real, but only if the units can be plated quickly.

If the fleet waits until the last week to file, one small issue, like a vehicle identification number typo or an EIN mismatch, can trigger an IRS rejection and delay the stamped Schedule 1. That delay can cascade into late IRP processing, rescheduled pickups, and lost billable miles.

The “investor” lesson here is simple: cash flow depends on compliance throughput. Treat 2290 and registration proof like a prerequisite for monetizing the asset.

Mistakes that cause DMV delays (and how to prevent them)

Most DMV counter rejections are not “tax” problems, they are documentation problems.

| Mistake | What happens | Prevention tactic |

|---|---|---|

| VIN entered incorrectly | Schedule 1 does not match the truck, DMV rejects it | Double-check VIN characters, especially O vs 0, and request a correction fast if needed |

| Wrong tax year selected | Proof is for the wrong period | Confirm you are filing for the correct HVUT tax year (July to June) |

| Waiting until the last day | No buffer for IRS rejections or payment issues | File before your registration appointment window |

| Not keeping retrievable records | You cannot find the stamped Schedule 1 when needed | Use a provider with secure storage and easy retrieval |

A simple compliance playbook (especially for fleets)

Fleets that consistently avoid DMV surprises use a repeatable workflow:

- Align internal HVUT filing dates with the earliest registration and IRP renewal dates in the fleet.

- Build a VIN verification step into the vehicle onboarding process (before filing).

- Maintain a centralized folder or dashboard where the latest stamped Schedule 1 is stored for every unit.

- Keep a small buffer for IRS rejections, especially in late summer.

If you prefer an IRS Authorized E-file Provider workflow, Simple Form 2290 is built to support fast, guided filing with bulk vehicle filings, secure record retrieval, and bilingual (English/Spanish) customer support.

Frequently Asked Questions

When is schedule 1 form 2290 due to dmv? It is due when your DMV or IRP office requires HVUT proof to complete a registration action, typically at renewal, new registration, or when adding a vehicle to IRP.

Is the hvut due date the same as my registration due date? Not always. The HVUT due date is set by IRS Form 2290 rules (often the last day of the month after first use). Your registration due date is set by your state. You need Schedule 1 by the earlier of the two deadlines that affects your operation, usually the registration transaction date.

Do I need Form 2290 Schedule 1 for IRP registration? In most cases, yes. IRP jurisdictions commonly require a stamped Schedule 1 as proof of HVUT filing for the VINs being registered or renewed.

What if my Schedule 1 has the wrong vehicle identification number? The DMV may reject it because the VIN on Schedule 1 must match the vehicle. You typically need to file a VIN correction so you can present accurate proof.

Can I electronic file form 2290 and pay online to get Schedule 1 faster? Yes. E-filing generally produces a stamped Schedule 1 much faster after IRS acceptance than paper filing, which can take significantly longer due to processing and mailing.

File early so the DMV is a quick stop, not a shutdown

If you want to reduce registration risk, the goal is simple: have your stamped Form 2290 Schedule 1 ready before your DMV or IRP transaction.

With Simple Form 2290, you can e-file through an IRS-authorized platform designed for owner-operators and fleets, get your Schedule 1 delivered quickly after acceptance, and retrieve it later when the DMV asks again.

Get started here: Simple Form 2290