IRS Website Login: Safe Access and Common Errors

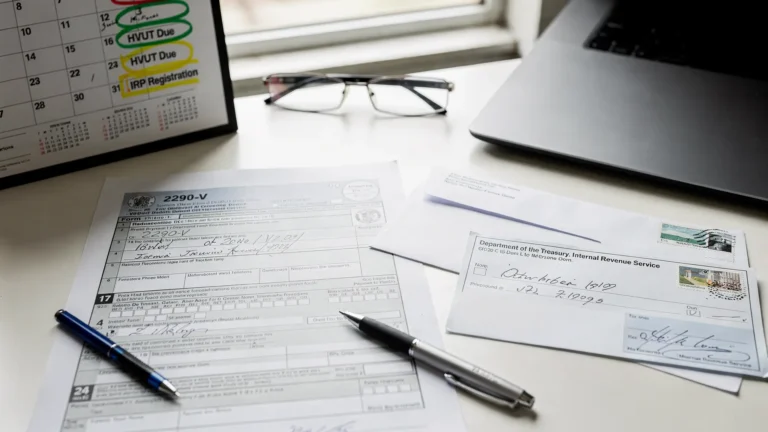

Logging into the IRS website is something many truckers and fleet owners do only when a deadline is close, a payment needs to be confirmed, or a notice shows up. That timing makes it easy to rush, click the wrong link, or get stuck on a confusing error screen.

This guide explains what “IRS website login” usually refers to, how to access IRS tools safely, and how to fix the most common login problems. It also clarifies a key point for HVUT filers: most taxpayers do not file Form 2290 directly on the IRS website. Form 2290 e-filing typically happens through an IRS-authorized e-file provider.

What “IRS website login” can mean (there is more than one)

People search “IRS website login” for different reasons, and the right login page depends on what you are trying to do.

IRS Online Account (individual)

This is the IRS’s main “Online Account” for individuals. It is accessed through IRS.gov and commonly uses an identity verification partner (often ID.me).

You can typically use it to view things like payment history, account balances, and certain tax records. Official entry point: IRS Online Account.

EFTPS (Electronic Federal Tax Payment System)

EFTPS is a separate system for making federal tax payments. It has its own enrollment and login flow. Official entry point: EFTPS.

IRS e-Services (tax professionals)

IRS e-Services is generally for authorized tax professionals and certain business services, not for typical owner-operators.

Form 2290 (HVUT) e-filing

For Heavy Vehicle Use Tax filing, the IRS does not offer a simple “log in and e-file Form 2290” experience for most taxpayers on IRS.gov. Instead, Form 2290 is e-filed through an IRS-authorized e-file provider.

If your goal is to file HVUT and get a stamped Schedule 1 quickly for registration/IRP, you will usually log in to your e-file provider’s portal (not an “IRS website login”).

Safe access checklist for IRS logins (how to avoid scams)

Because IRS-related phishing is common, security should come before troubleshooting.

Here are practical steps that reduce risk significantly:

- Start from IRS.gov, not from email or text links. Type the address yourself or use a saved bookmark.

- Confirm the domain is irs.gov (not a lookalike). The IRS publishes guidance on scams and phishing here: IRS phishing and online scams.

- Look for HTTPS and the correct domain before entering credentials.

- Use multi-factor authentication (MFA) whenever it is offered.

- Avoid public Wi‑Fi for logins (or use a trusted, secure connection).

- Keep your phone number and email current for 2FA recovery.

Security note: The IRS generally does not initiate contact by email, text, or social media asking you to provide personal information. When in doubt, do not click and do not reply. Go directly to IRS.gov.

How to access the IRS Online Account safely (high-level flow)

The exact steps and screens can change, but the secure approach stays consistent:

Use the official IRS entry point

Go to the IRS Online Account page on IRS.gov and choose the sign-in option: Your Online Account.

Complete identity verification if prompted

You may be asked to verify your identity (often through the IRS identity provider flow). This is where many users hit roadblocks (more on that below).

Enable or confirm MFA

If you have the choice, prefer an authentication method you can reliably access every time (for example, an authenticator app). If you change phone carriers or numbers frequently, SMS codes can become a common failure point.

Common IRS website login errors (and how to fix them)

Login issues usually fall into a few buckets: wrong credentials, MFA problems, browser/device blocks, or identity verification failures.

Quick reference table: symptoms, causes, fixes

| Symptom or error | Most common cause | What to try first |

|---|---|---|

| “Incorrect username or password” | Typo, wrong account, saved password outdated | Reset password, confirm you are on the correct site (IRS.gov vs EFTPS) |

| “Account locked” / too many attempts | Multiple failed logins, automated security lock | Wait the stated time, then use the official password reset process |

| MFA code not arriving | Phone number changed, carrier filtering, wrong method selected | Try a different MFA method if available, confirm phone signal, check spam filters |

| “Access Denied” | VPN/proxy, corporate network rules, browser security settings | Disable VPN, try a different network, use a standard home connection |

| Blank page or login loop | Cookies/cache conflict, browser extensions | Use a private window, clear cookies for IRS.gov, disable ad blockers temporarily |

| “Session timed out” repeatedly | Idle timeouts, unstable connection | Refresh and log in again on a stable connection |

| Identity verification fails | Name/address mismatch, document issues, credit file questions | Re-check personal data, use consistent address formats, follow the verification help guidance |

| You can log in but cannot find what you need | Looking in the wrong system (Online Account vs EFTPS vs provider portal) | Confirm the goal (payments vs transcripts vs HVUT filing) and use the correct portal |

Step-by-step troubleshooting (works for most login problems)

If you are getting errors and need a practical sequence, this order fixes the majority of issues without creating new ones.

Confirm you are on the right login page

Before changing anything, verify you are using the correct system:

- For IRS Online Account: IRS Online Account

- For EFTPS payments: EFTPS

A common mistake is trying to use IRS Online Account credentials on EFTPS, or assuming one login works everywhere.

Try a “clean” browser session

Browser conflicts are extremely common.

Use this progression:

- Open a private/incognito window and try again.

- If that fails, clear cookies and cache for IRS.gov.

- Temporarily disable extensions that modify pages (ad blockers, script blockers, some privacy tools).

- Try a different browser (Chrome, Edge, Safari, Firefox).

Disable VPNs and network filters

If you are using a VPN or a corporate network, turn it off and try again from a normal home or mobile connection. “Access Denied” often points to this.

Use the official password reset (do not keep guessing)

If you are not 100 percent sure about the password, avoid repeated attempts. Too many tries can lock the account.

Use the “Forgot password” flow on the official site instead of continuing to guess.

Fix MFA problems the right way

If 2FA codes are the issue:

- Confirm the phone number on file is current.

- Make sure your phone time and date are set automatically (time mismatches can break some authentication methods).

- If you have an authenticator option, consider switching to it for more consistent access.

Identity verification issues

If the login flow requires identity verification and you cannot pass it, the fix is usually data consistency:

- Use the same name format that appears on your tax records.

- Use your current, correct mailing address exactly as it appears on IRS communications.

- If asked for documents, ensure photos are clear and unexpired.

If you are stuck, use the help options provided in the verification flow or on IRS.gov, and avoid third-party “verification services” advertised in search ads.

When you should contact the IRS (and what to have ready)

If you are locked out repeatedly, cannot regain access through the official recovery steps, or have an urgent compliance deadline, contact the IRS through official channels.

To reduce time on hold, have these ready:

- Your full legal name and current address

- Your EIN (for business tax matters) or SSN/ITIN (for individual account matters)

- The exact error message and the date/time it occurred

- Any related IRS letter or notice number (if applicable)

For Form 2290 and HVUT-related questions, you can also review this SimpleForm2290 resource with official contact details: IRS customer support phone numbers.

Important for truckers: IRS login is usually not how you file Form 2290

If your main goal is HVUT compliance and getting your stamped Schedule 1 for registration, you typically do not need an IRS Online Account login to e-file Form 2290.

In most cases:

- Form 2290 is e-filed through an IRS-authorized e-file provider.

- You log in to your provider account to file, track acceptance, and retrieve Schedule 1.

That distinction matters because it avoids wasted time when you are up against a plate renewal or IRP deadline. If you already filed and are trying to confirm what happened, you may be looking for a filing status update rather than an IRS.gov login fix. (Related: How to check 2290 filing status.)

How to avoid login issues next time (simple prevention)

Most recurring login problems are preventable with a few habits:

- Bookmark the exact IRS.gov page you use most often (avoid searching every time).

- Keep MFA methods current, especially after changing phone numbers.

- Use a password manager so you do not rely on old saved passwords.

- Avoid filing-day logins for first-time setup. Do account setup and verification during a low-stress period.

Frequently Asked Questions

What is the official IRS website login page? The IRS Online Account sign-in starts from the official IRS.gov page here: Your Online Account. Payments through EFTPS use a separate login at EFTPS.

Why am I getting “Access Denied” when trying an IRS website login? This is often caused by VPN/proxy use, network security filters, or browser settings/extensions. Try disabling VPN, switching networks, and using a private window.

I need my Form 2290 Schedule 1. Do I log into the IRS website for that? Typically no. Most taxpayers receive the stamped Schedule 1 through their IRS-authorized e-file provider portal after IRS acceptance.

What should I do if my IRS login is locked? Stop attempting repeated logins. Use the official password reset and follow the lockout wait time shown on the screen. If you still cannot regain access, contact the IRS through official channels.

Can I e-file Form 2290 directly on IRS.gov? Most owner-operators and fleets e-file Form 2290 through an IRS-authorized provider rather than filing directly on IRS.gov.

File Form 2290 without IRS login confusion

If your goal is HVUT compliance and getting Schedule 1 fast, using an IRS-authorized e-file provider can be simpler than troubleshooting an IRS website login.

Simple Form 2290 is an IRS-authorized e-file provider built for truckers and fleets, with a guided filing process, bulk vehicle filing options, bilingual support (English/Spanish), secure data storage, and instant Schedule 1 delivery after IRS acceptance.

Get started here: E-file Form 2290 with SimpleForm2290.